Fair value yahoo finance 331336-Fair value yahoo finance

Pr5lukztyk7arm

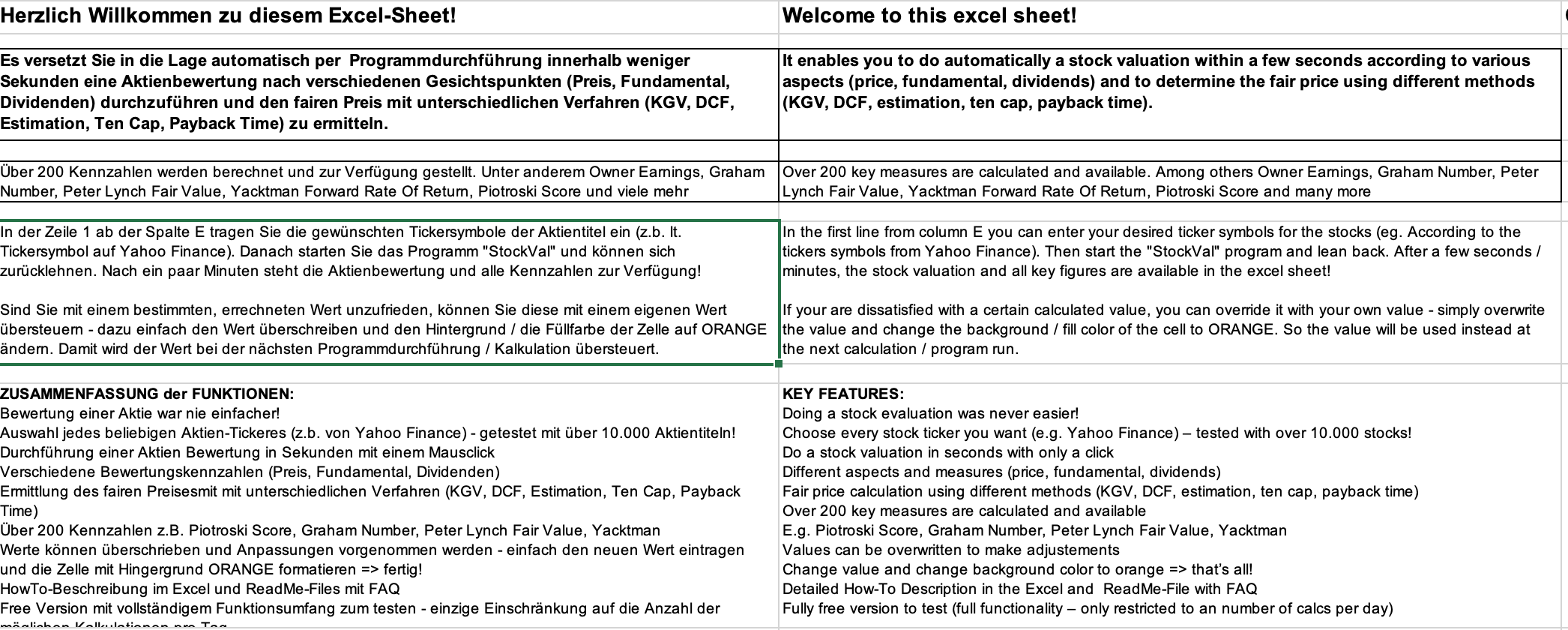

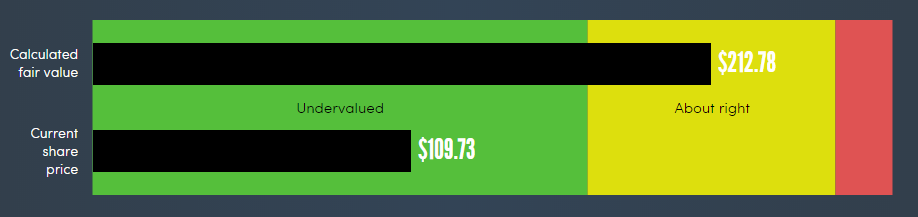

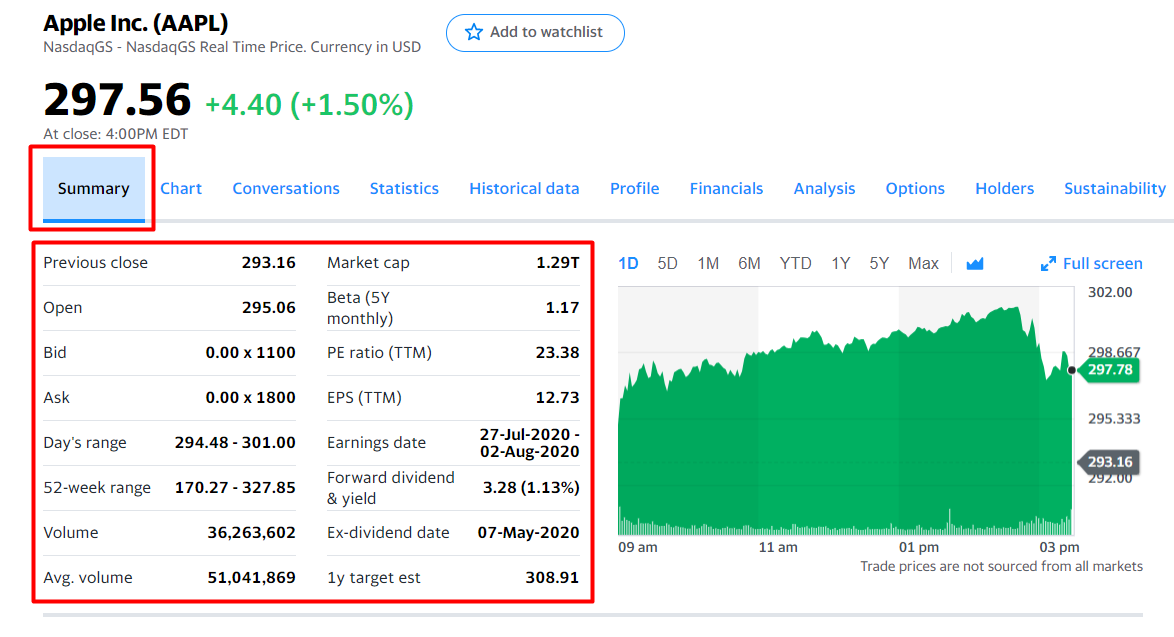

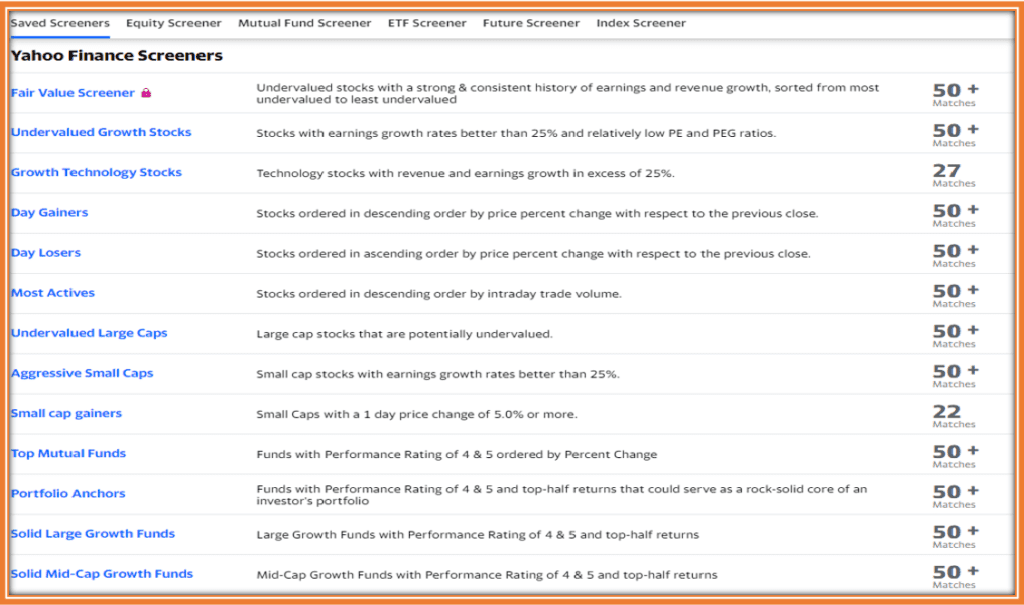

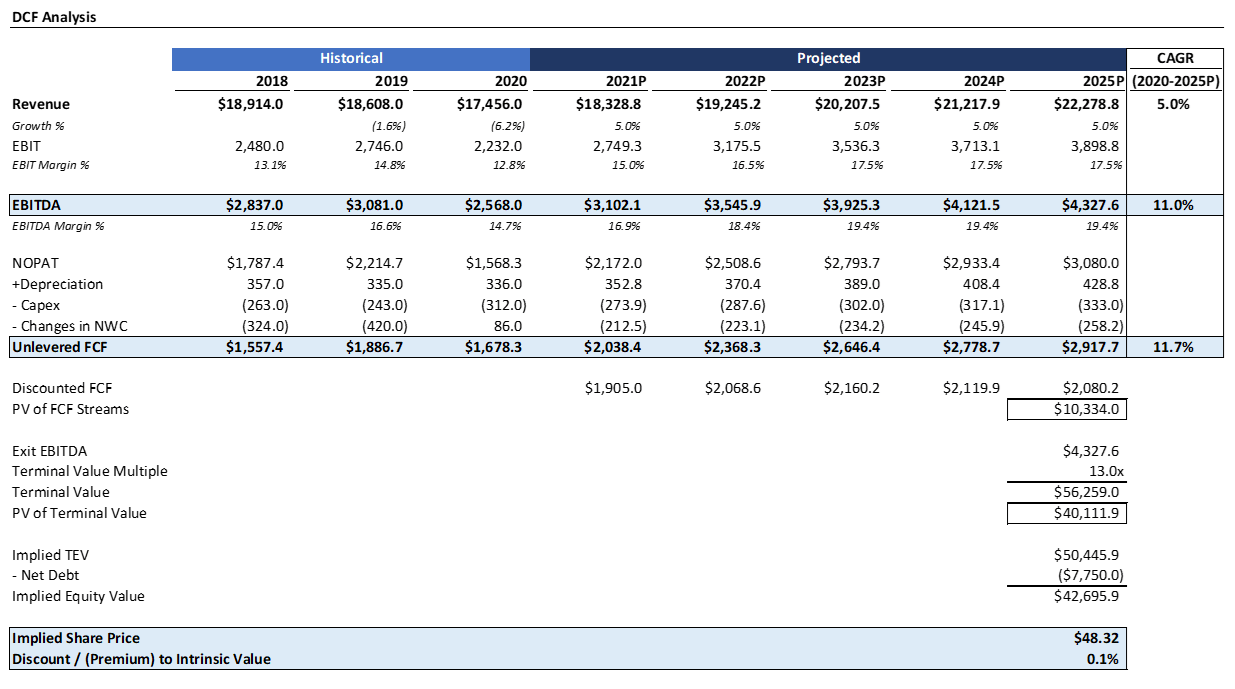

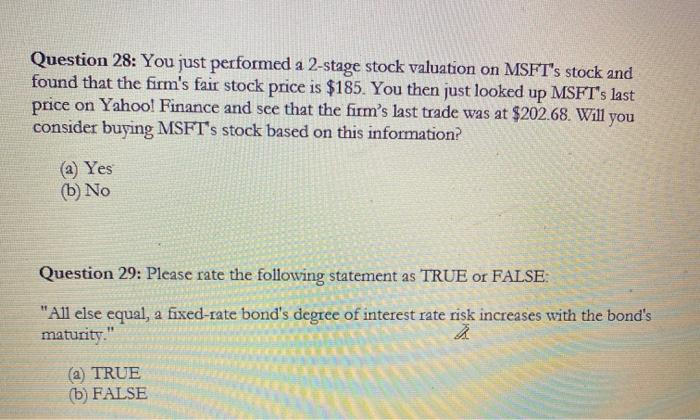

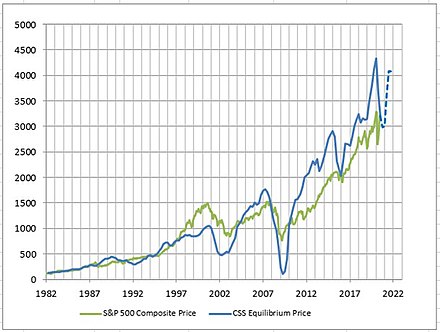

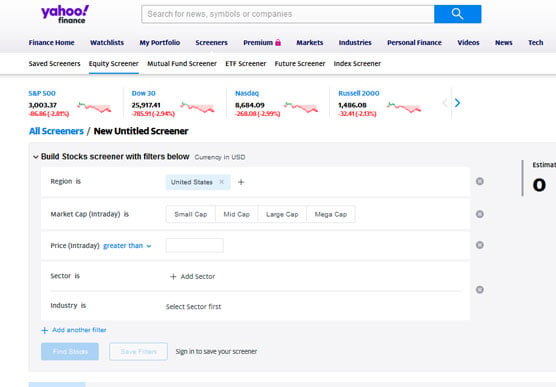

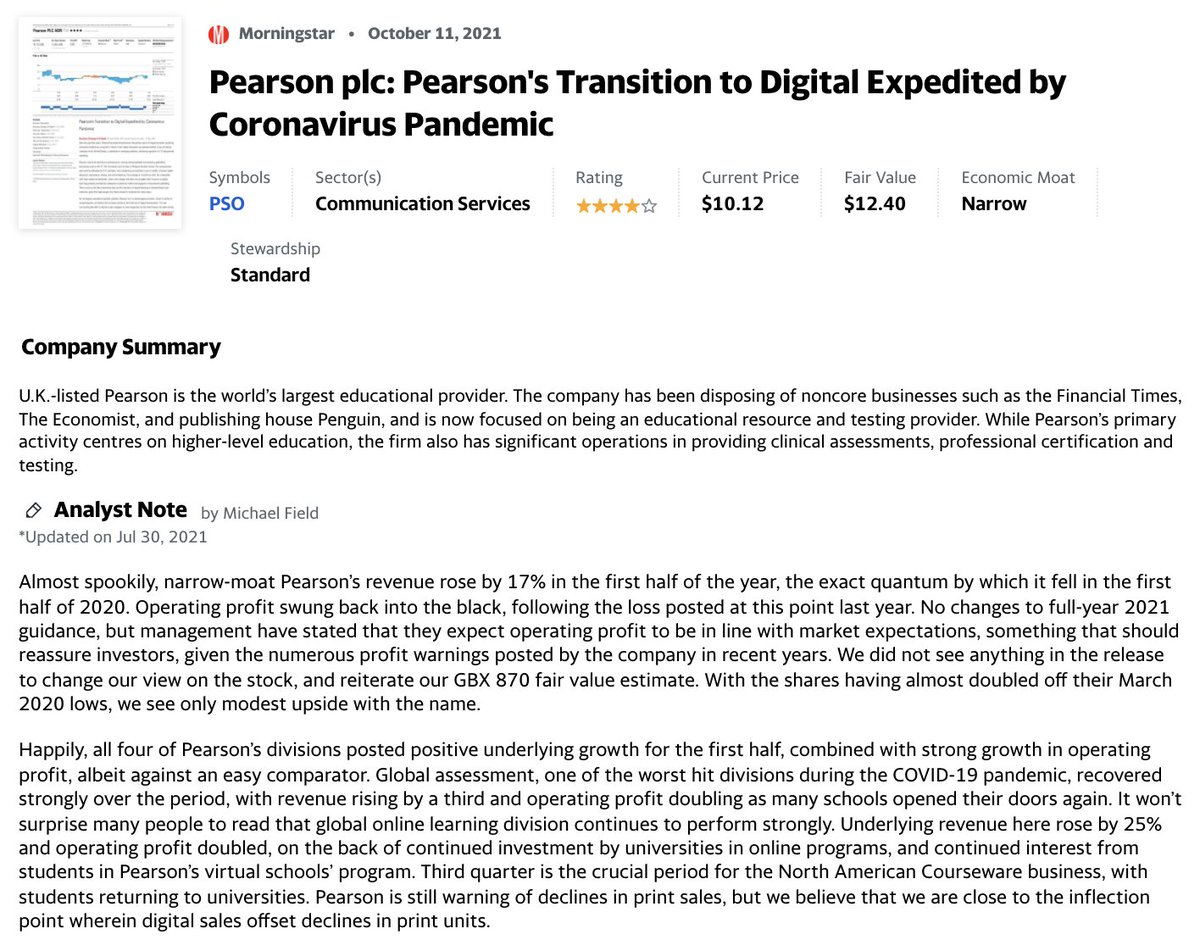

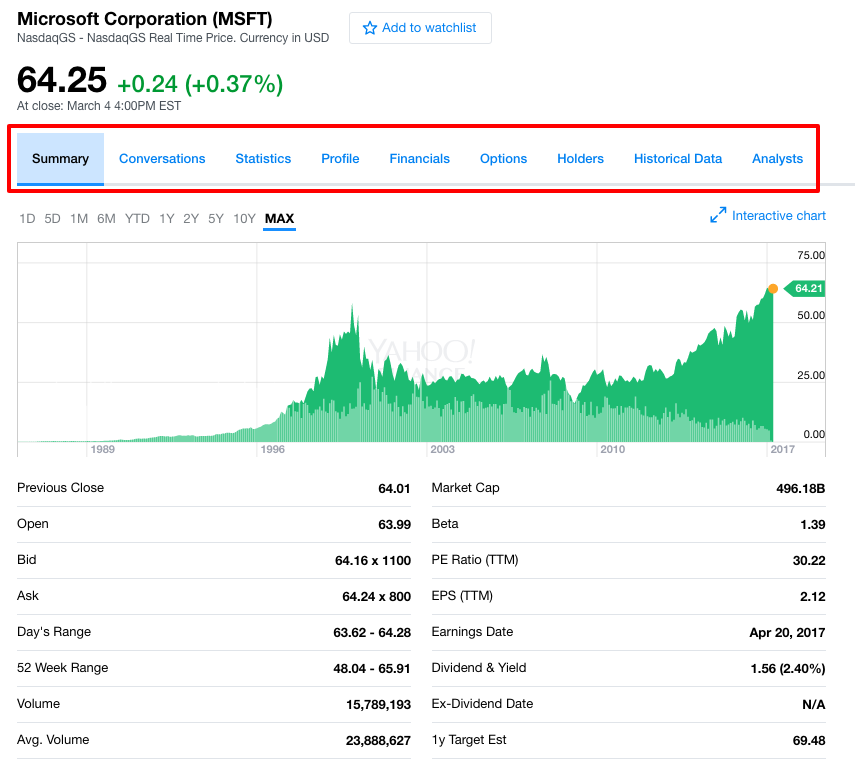

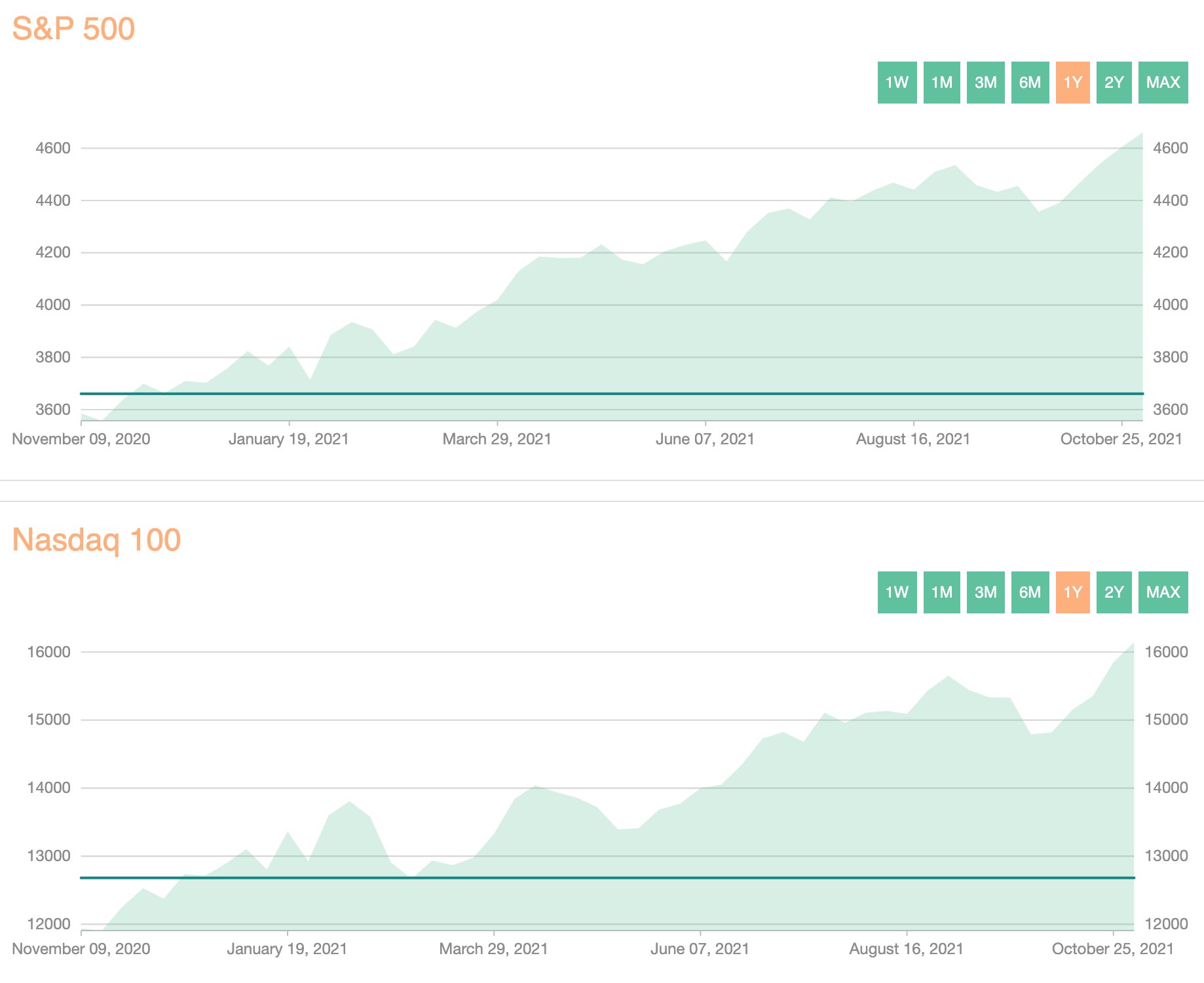

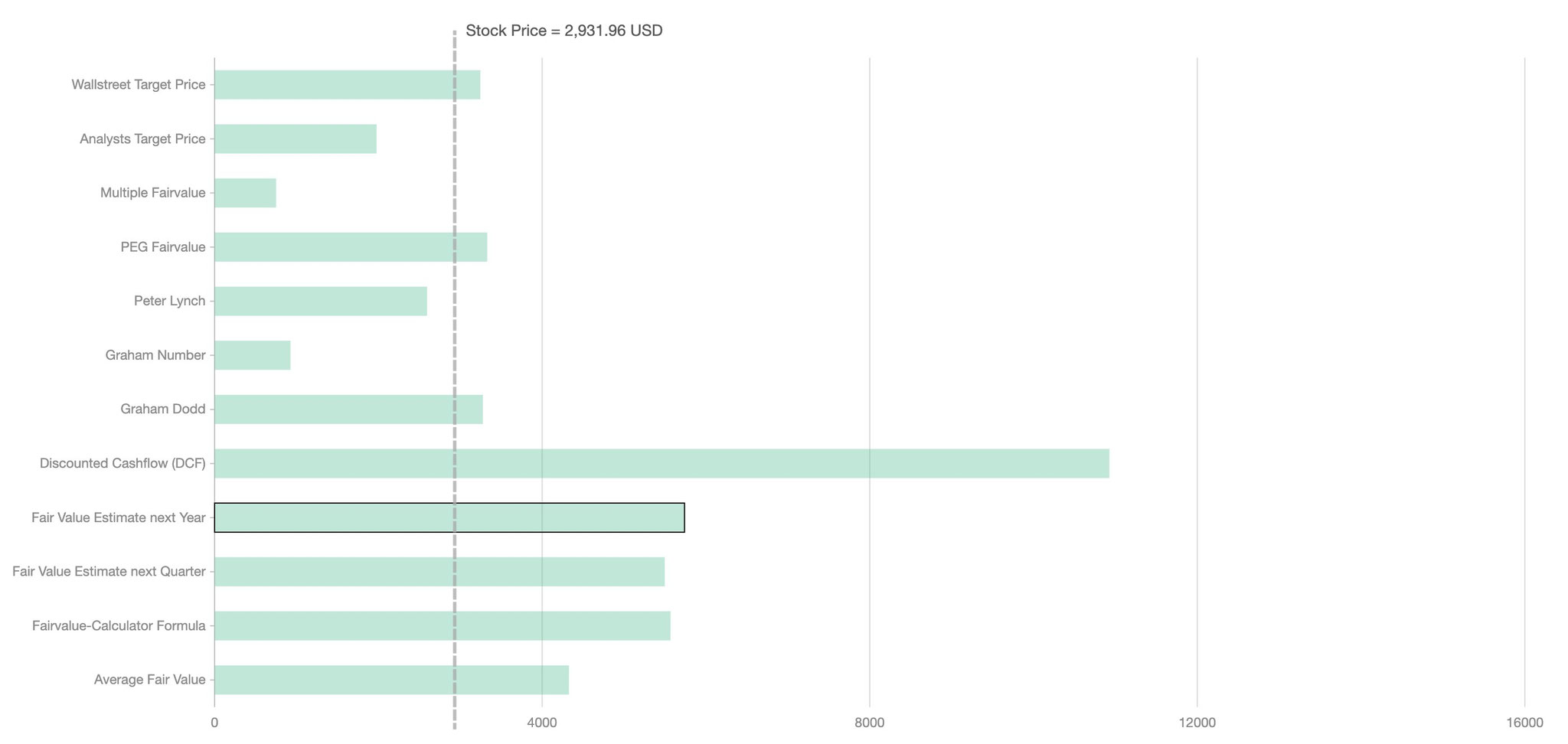

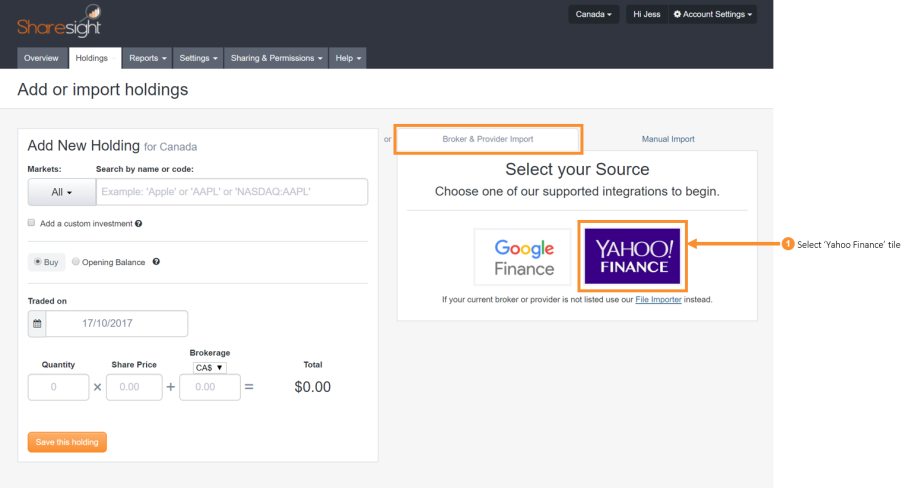

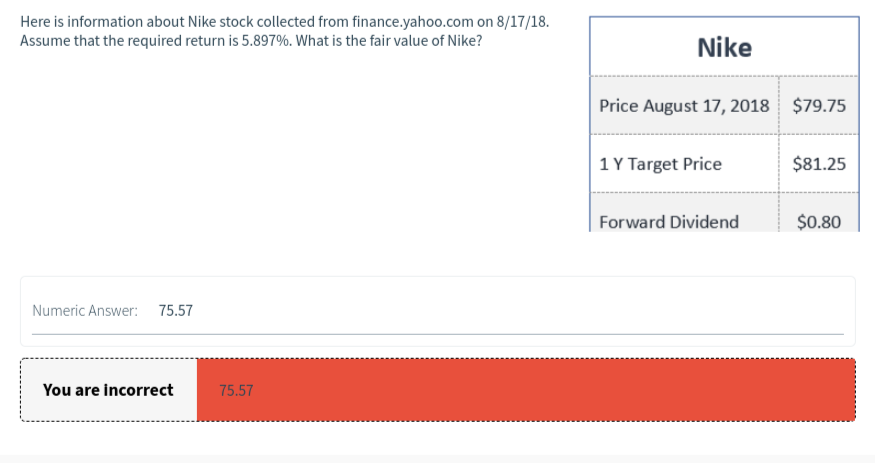

In the final step we divide the equity value by the number of shares outstanding Relative to the current share price of UK£29, the company appears about fair value at a 13% discount to where the stock price trades currently Remember though, that this is just an approximate valuation, and like any complex formula garbage in, garbage out dcfTop Free Stock Screeners 1 Yahoo Finance stock screener The free Yahoo Finance stock screener is personally my favourite stock screener, since its user interface is very clean, and they cover stocks from the US, Canada, India, UK, Europe, and more Also, once you've filtered down the list using their screener, Yahoo has a lot of valuable

Fair value yahoo finance

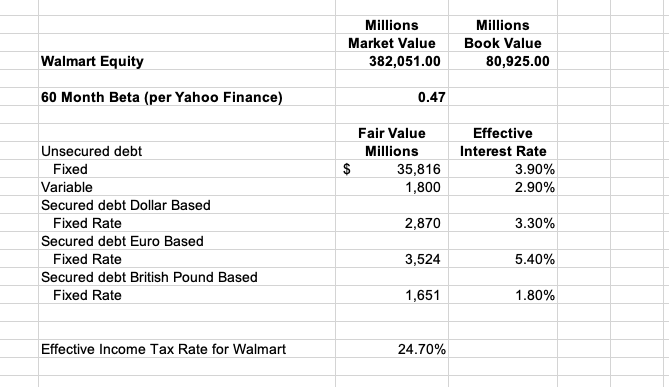

Fair value yahoo finance- Present Value of Terminal Value (PVTV)= TV / (1 r) 10 = AU$30b÷ ( 1 54%) 10 = AU$18b The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is AU$25b The last step is to then divide the equity value by the number of shares outstanding Terminal Value (TV)= FCF 31 × (1 g) ÷ (r – g) = CA$70m× (1 16%) ÷ (61%– 16%) = CA$155m Present Value of Terminal Value (PVTV) = TV / (1 r) 10 = CA$155m÷ ( 1 61%) 10 = CA$86m The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is CA$142m

1

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is UK£43m In the final step we divide the equity value by the number of shares outstanding Compared to the current share price of UK£08, the company appears around fair value at the time of writing In the same way as with the 10year 'growth' period, we discount future cash flows to today's value, using a cost of equity of % Terminal Value (TV)= FCF 31 × (1 g) ÷ (r – g) = UK£345m× (1 09%) ÷ (%– 09%) = UK£44b Present Value of Terminal Value (PVTV)= TV / (1 r) 10 = UK£44b÷ ( 1 %) 10 = UK£19b Present Value of Terminal Value (PVTV) = TV / (1 r) 10 = AU$29b÷ ( 1 65%) 10 = AU$15b The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is AU$21b The last step is to then divide the equity value by the number of shares outstanding Compared to the current share price

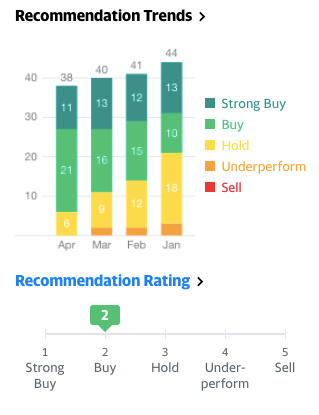

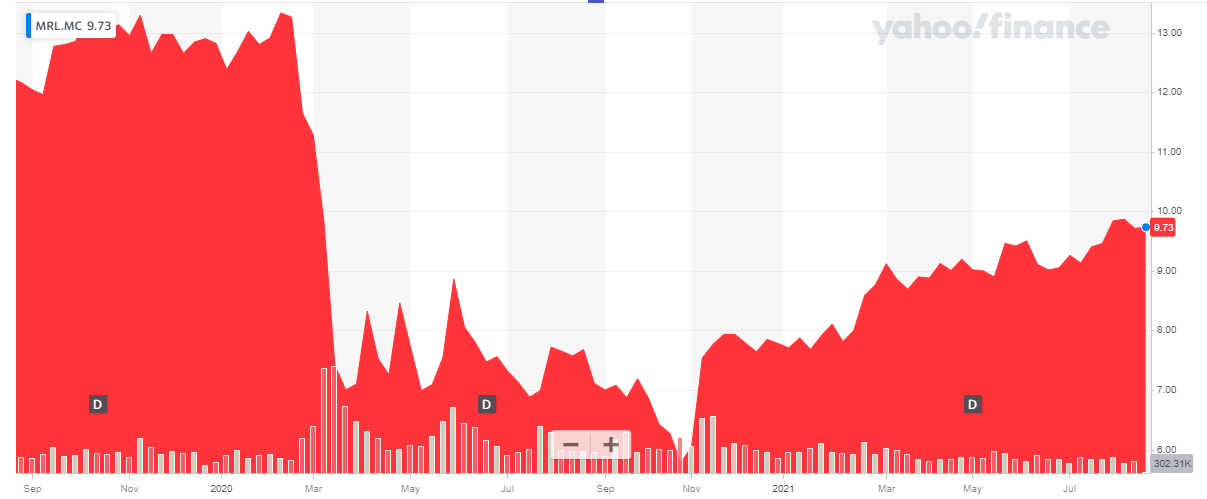

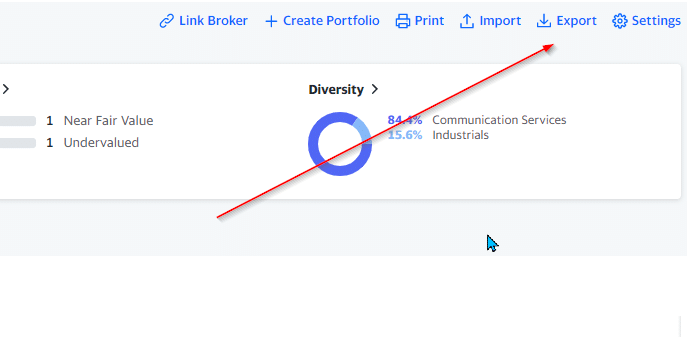

Finance I combine value investing with dividend stocks to achieve optimal financial returns the users get a fair value analysis of portfolios from significant investorsYahoo Finance Premium "Fair Value Indicator" I have been using Yahoo Finance Premium to help me screen stocks for swing trades I like their "fair value" indicator I know it is an opinion of whether the stock is over or under valued but using that as a factor has helped me in my screening process I also really like the layout of each stock Compared to the current share price of AU$08, the company appears around fair value at the time of writing Remember though, that this is just an approximate valuation, and like any complex formula garbage in, garbage out Value Per Share = Expected Dividend Per Share / (Discount Rate Perpetual Growth Rate) = AU$006 / (57% – 19%) = AU$07

Fair value yahoo financeのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

|  |  |

|  | |

|  |  |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  |  |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

| ||

|  |  |

| ||

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

| ||

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

| ||

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  | |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

| ||

|  |  |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  | |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  |  |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「Fair value yahoo finance」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|

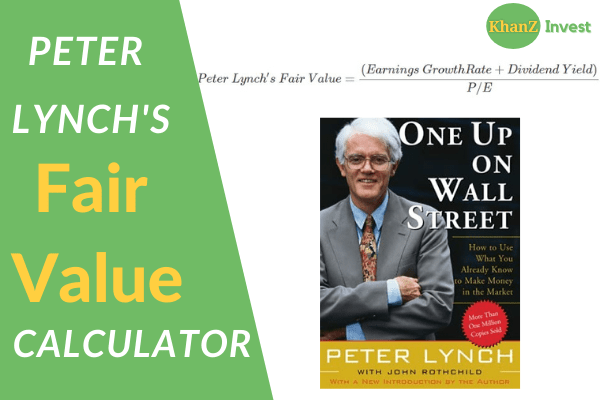

To get the intrinsic value per share, we divide this by the total number of shares outstanding Relative to the current share price of AU$2, the company appears about fair value at a % discount to where the stock price trades currentlyFair Value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when P/E Ratio = Growth Rate

Incoming Term: fair value yahoo finance, yahoo finance fair value reddit, yahoo finance fair value screener, yahoo finance fair value stocks, yahoo finance fair value review,

コメント

コメントを投稿